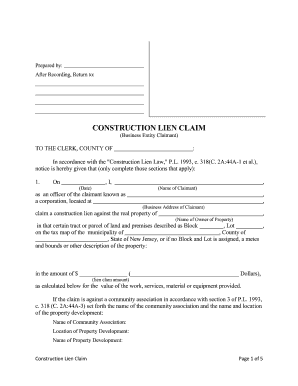

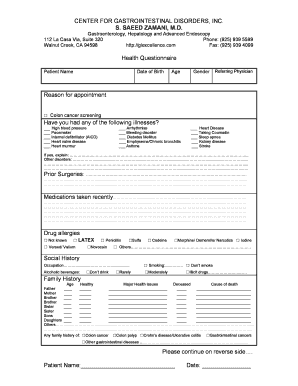

A Notice form provides legal notification to a party of an important aspect of a legal matter. Failure to provide proper notice is often the cause of delays in the progress of lawsuits and other legal matters. This model form, a Notice of Unpaid Balance and Right to File Lien — Residential— — Individual — New Jersey Mechanic Liens, provides notice of the stated matter. Because each case is unique, you will need to adapt the form to fit your specific facts and circumstances.

NJ Notice of Unpaid Balance Right to File free printable template

Show details

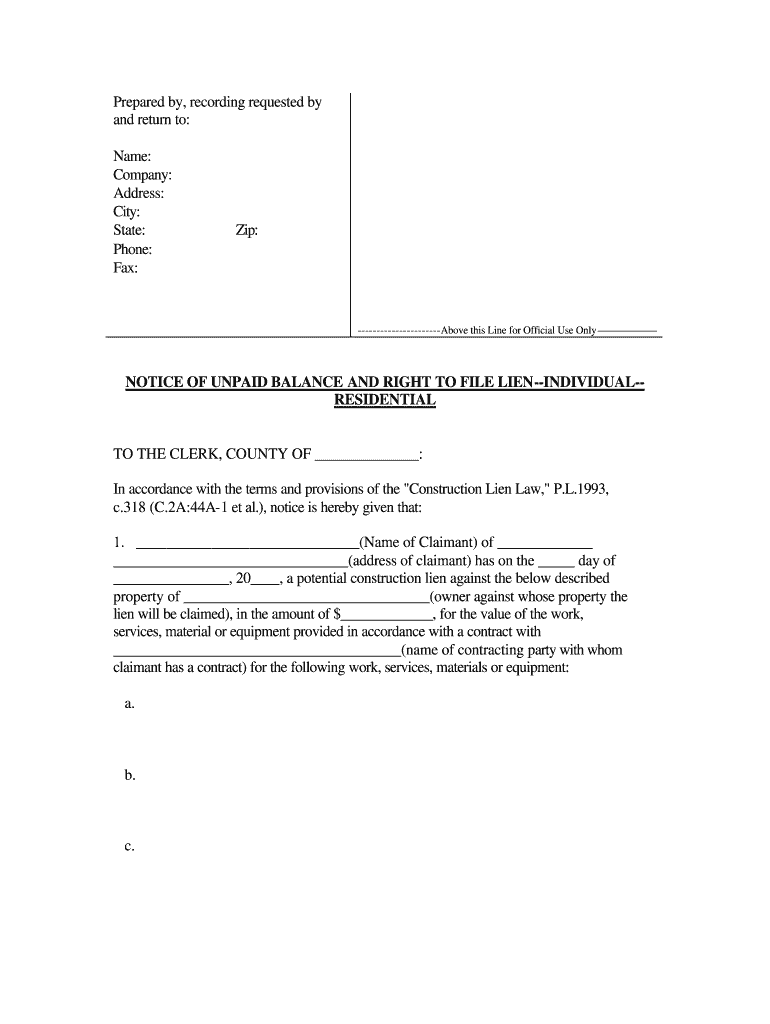

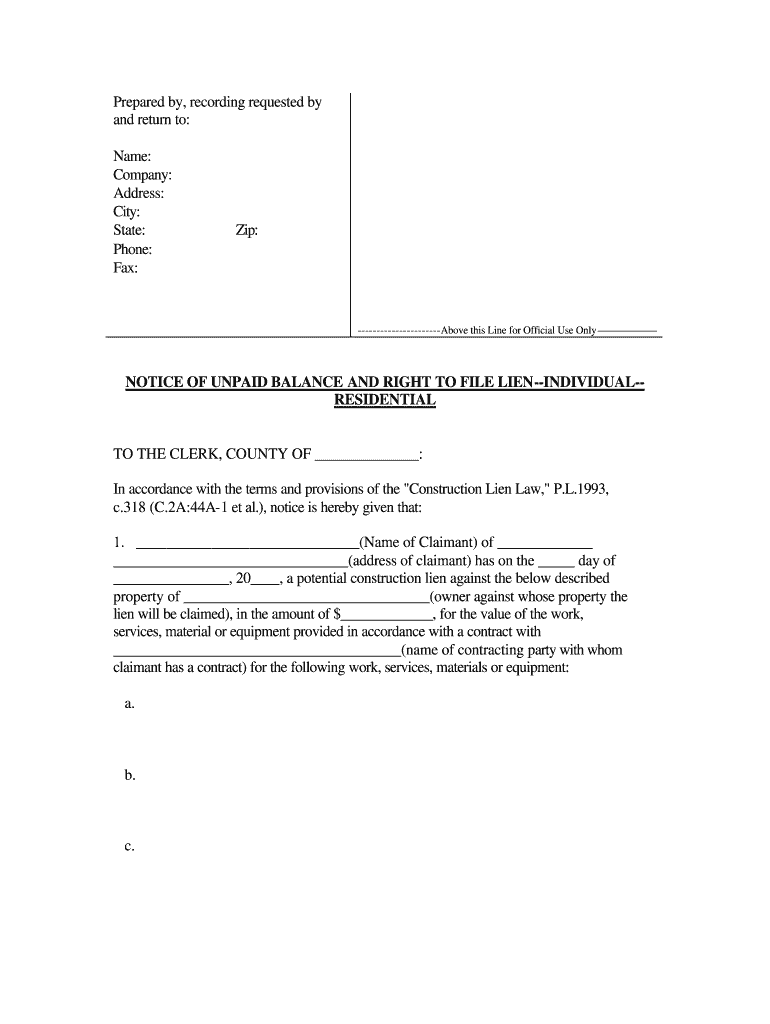

The Notice of Unpaid Balance and Right to File Lien has been filed within 90 days from the last date upon which the work services materials or equipment for which 4. The amount claimed herein is due and owing at the date of filing pursuant to claimant s contract described in the Notice of Unpaid Balance and Right to File Lien. and Right to File Lien is filed was provided exclusively in connection with the 3. Prepared by recording requested by and return to Name Company Address City State...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign notice of unpaid balance form nj

Edit your notice of unpaid balance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your notice of unpaid balance and right to file lien form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing notice of unpaid balance and right to file lien nj online

In order to make advantage of the professional PDF editor, follow these steps:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit notice form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out collection for unpaid balance template form

How to fill out NJ Notice of Unpaid Balance & Right to File

01

Obtain the NJ Notice of Unpaid Balance & Right to File form from the appropriate source.

02

Fill in the debtor's information, including their name and address.

03

Clearly state the amount owed in the designated section.

04

Provide a description of the debt, including the type of service or goods provided.

05

Include any relevant account numbers or reference numbers in the form.

06

Attach any supporting documentation that verifies the unpaid balance, if applicable.

07

Sign and date the form to validate your claim.

08

Send the completed form to the debtor via certified mail for proof of delivery.

Who needs NJ Notice of Unpaid Balance & Right to File?

01

Creditors who have provided goods or services and have not received payment.

02

Businesses or individuals seeking to formalize a claim for unpaid balances.

03

Landlords who need to notify tenants of overdue rent.

04

Service providers like contractors or freelancers who want to assert their right to payment.

Fill

nj lien application

: Try Risk Free

People Also Ask about use the official form

What is required to file lien in Illinois?

In Illinois, the lien must be verified by the subcontractor with an affidavit, and must include a statement detailing the contract, the balance due, and the legal description of the property that you are attaching the lien to.

Are lien waivers required in Illinois?

Illinois does not provide or require statutory forms for lien waivers. For an Illinois lien waiver to be valid, it must be completed by an express agreement that clearly states the intent to waive lien rights. Both conditional and unconditional lien waivers are allowed, but conditional is viewed as the safer option.

What is the lien law in Illinois?

The lien prevents the owner of the property from transferring the property without first paying the contractor who holds the lien. The mechanics lien also allows the contractor who holds the lien to foreclose on the property and have it sold in order to make sure the contractor gets paid.

What is an intent to lien form in Illinois?

An Illinois Notice of Intent to Lien, also known as a “90-day Notice,” is a critical step to secure your Illinois mechanics lien rights on a private construction project. This Illinois lien notice form is required to be sent by any potential lien claimants who did not contract directly with the property owner.

How do I file a lien in Illinois?

472 articles Watch: How to file a lien in Illinois. Step 1: Determine if you have lien rights. Step 2: Send a notice to the owner. Sworn statement to owner. Step 3: Prepare your Illinois lien claim form. Choose the right form. Step 4: Record your Illinois mechanics lien. What to do after filing a lien.

How long do you have to file a lien in Illinois?

Illinois sets a rule that filing a mechanics lien must be at the latest within four months after the completion of work provided to be good against the owner, any lien claimants or subsequent owners.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit legal response to demand letter template from Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your unpaid balance into a dynamic fillable form that can be managed and signed using any internet-connected device.

How do I edit NJ Notice of Unpaid Balance Right to File online?

The editing procedure is simple with pdfFiller. Open your NJ Notice of Unpaid Balance Right to File in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

How do I edit NJ Notice of Unpaid Balance Right to File straight from my smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing NJ Notice of Unpaid Balance Right to File.

What is NJ Notice of Unpaid Balance & Right to File?

The NJ Notice of Unpaid Balance & Right to File is a legal document used in New Jersey that notifies individuals that a balance is owed and outlines their right to file for payment.

Who is required to file NJ Notice of Unpaid Balance & Right to File?

Creditors or service providers who have not received payment for services rendered or debts owed are required to file the NJ Notice of Unpaid Balance & Right to File.

How to fill out NJ Notice of Unpaid Balance & Right to File?

To fill out the NJ Notice of Unpaid Balance & Right to File, one must provide details such as the debtor's name and address, the amount owed, the nature of the debt, and any relevant account numbers.

What is the purpose of NJ Notice of Unpaid Balance & Right to File?

The purpose of the NJ Notice of Unpaid Balance & Right to File is to formally inform the debtor of their unpaid balance and to clarify the creditor's right to file a legal claim for the owed amount.

What information must be reported on NJ Notice of Unpaid Balance & Right to File?

The information that must be reported includes the debtor's personal information, details of the unpaid balance, the date the balance became due, and the creditor's contact information.

Fill out your NJ Notice of Unpaid Balance Right to File online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NJ Notice Of Unpaid Balance Right To File is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.